When it comes to getting a brokerage service, it has to correspond to your investing goals and learning style to get the most profit out of your investment. Therefore, choosing the finest online stock broker for your needs, especially for beginner investors, can mean the difference between an exciting new income and a frustrating disappointment.

We’ll break down everything you should look for in your ideal brokerage in this guide in order to make the best choice for your finances.

Table of Contents

How much are online stock brokers in Calgary?

Although a stock broker’s fees may fluctuate, the following prices are a rough estimate on what they may charge their clients:

Here’s a quick tour on what these fees mean for online stock brokers:

- Account Minimums – This is the minimum amount you must deposit into a brokerage account in order to open it.

- Trade commissions – This is a brokerage cost that is imposed when you buy or sell stocks. Other investments, such as options or exchange-traded funds, or ETFs, may incur commissions or fees when purchased and sold.

- Expense Ratio – A percentage of your investment in mutual funds, index funds, and exchange-traded funds are levied as an annual fee.

- Mutual fund transaction fee – Another brokerage fee, this time for buying and/or selling mutual funds.

It’s important to note that trading fees, deposits, and stock trade fees are usually free for some contractors. We placed such a big margin because we wanted to take into consideration platforms that are for beginners, which usually don’t have any fees, and for pro traders, which charge more.

And now that we’ve discussed how much their services cost, we now tackle how to choose the best broker for your needs.

The Best Online Stock Brokers in Calgary

So, how do you pick the best online brokerage firm? There are numerous elements to examine in order to simplify the decision-making process. Some would look for a cutting-edge platform that will charge fewer fees or charges, while others prefer to bank with established financial institutions with a strong brand identity.

For us, we decided to base it on four important factors:

We’ve evaluated our entries with these criteria. And without future ado, we now discuss our top picks for the best online stock brokers in Calgary.

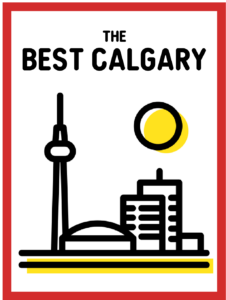

1. Questrade

| Criteria | Rating |

| Commission and Fees | ★★★★★ (5/5) |

| Deposits/Fund fees | ★★★★★ (5/5) |

| Trades/Margin | ★★★☆☆ (3/5) |

| Customer Satisfaction | ★★★★★ (5/5) |

| UX/UI | ★★★★★ (5/5) |

| Services | ★★★★☆ (4/5) |

| Security | ★★☆☆☆ (2/5) |

| Range of Offerings | ★★★★★ (5/5) |

Questrade is one of the original discount brokerages and is currently one of the most affordable in the market. It’s a beginner-friendly trading platform with great UX/UI that is easy to navigate.

What we like about this platform is its low commissions, a free trading platform, live data packages from the United States and Canada. Their active trader incentives are also all too tempting to pass up.

The firm offers two programs for active traders: a fixed and a variable plan. For high-volume and options traders, the fixed plan is marketed as the ideal solution.

Though, one thing we have to point out is that despite having low non-trading fees and low fund fees, it has high margin rates. Not only that, it doesn’t offer cryptocurrencies as a vessel for trading.

We also noted that it doesn’t accept cards that aren’t VISA, so that pigeonhole investors into specific banking methods only. Their withdrawal is also slower compared to other platforms, but if these aren’t something that bothers you, this could be a good option for you!

As we’ve mentioned, Questrade is great for beginners, as it offers a demo account that would help you test out the waters and their offerings. Furthermore, Questrade is a member of the Canadian Investor Protection Fund (CIPF) and also has private insurance, so investments are protected up to $10 million in the case of the company’s failure.

Pros

- Low non-trading fees

- Beginner-friendly

- No deposit requirement

- Zero Inactivity fee

Cons

- High margin rates

- Don’t accept cryptocurrency

Customer Reviews:

I have had nothing but exceptional services with Questrade.

“I have had nothing but exceptional service with Questrade since joining last year – the online chat system is super convenient as you don’t have to wait on hold over the phone. They always fix any issue I have right away, and the platform is so easy to use. They also have a ton of online resources to help with research and FAQs.”

My experience with Questrade is pretty good.

“My experience with Questrade is pretty good. What I like the most is that the website is very ergonomic and easy to use. Depending on how/what you invest, it could be the cheapest broker. Customer support is awesome even though sometimes it can take time to get to someone. You can ask them anything on the phone and they’ll do their best to answer. You can even ask them technical questions and strategies and they will explain to you. I would recommend Questrade to the investor that is moderately active and has part of his/her investments in US stocks.”

2. Wealthsimple

| Criteria | Rating |

| Commission and Fees | ★★★★★ (5/5) |

| Deposits/Fund fees | ★★★★★ (5/5) |

| Trades/Margin | ★★★☆☆ (3/5) |

| Customer Satisfaction | ★★★★★ (5/5) |

| UX/UI | ★★★★★ (5/5) |

| Services | ★★★★★ (5/5) |

| Security | ★★★★☆ (4/5) |

| Range of Offerings | ★★★★☆ (4/5) |

Wealthsimple is a fully regulated online platform suited for beginning investors. They offer automatic trading for individuals who want to manage their financial portfolios.

Wealthsimple Trade is technically the most affordable online Canada broker because trades are unrestricted and there is no minimum deposit. A 1.5 percent currency exchange fee is how the platform makes money.

This platform offers easy access to financial advisors. Though their services are tiered, every Wealthsimple client has unrestricted access to human financial advisors.

One of the things that make Wealthsimple stand out is the way they provided their portfolio. Apart from their 4 diverse choices, they also offer a halal option, perfect for Muslim traders looking for an option to fit Islamic law.

This halal option contains a 50-stock Islamic investing portfolio in the form of an ETF. As a result, the portfolio adheres to Shariah rules based on the Quran.

Most of their portfolios are generally diverse, however, we wanted to point out that it lacks exposure to international bonds. If you’re also someone who would like to trade outside Canada and the US, better skip this option.

Wealthsimple Trade features no trading costs and has a fabulous user-friendly platform. It’s also a great place to dip your toes in because not only does it have no minimum deposit, but you can also access human advisors in case you want to know more.

Pros

- No trading fees

- User-friendly platforms

- Free portfolio analysis

- Access to human advisors

- Halal option available

Cons

- Lacks exposure to international bonds

- Higher account management fees

- Limited

Customer Reviews:

WealthSimple has exceeded my expectations.

“WealthSimple has exceeded my expectations thus far, and I can’t wait to see what the future holds! The transfer of my current ISA investment went without a hitch thanks to the company’s pleasant and helpful customer service. When it comes to customer service, they’ve done an excellent job, so I’m confident that they’ll continue to attract more customers in the future.”

I’ve been using Wealthsimple for a few years now and they’ve been great.

“I’ve been using Wealthsimple for a few years now and they’ve been great. I don’t have time to manage my own portfolio and as a robo investor they’ve been able to deliver great returns with low fees and allow me to have the peace of mind without all of the up selling hassles of being with a big bank or a broker paid on commission.”

3. Qtrade Direct Investing

| Criteria | Rating |

| Commission and Fees | ★★★★☆ (4/5) |

| Deposits/Fund fees | ★★★★★ (5/5) |

| Trades/Margin | ★★★★☆ (4/5) |

| Customer Satisfaction | ★★★★★ (5/5) |

| UX/UI | ★★★★★ (5/5) |

| Services | ★★★★★ (5/5) |

| Security | ★★★★★ (5/5) |

| Range of Offerings | ★★★★☆ (4/5) |

Qtrade Direct Investing is a cost-effective broker for frequent traders and young investors. They offer a pocket for Canadian investors to take a dip into international markets as well.

Apart from domestic Canadian markets, the trading platform also allows you to access the New York Stock Exchange as well as the NASDAQ. This means that it gives you a significant advantage if you’re the kind of investor who would like to expand and diversify your portfolio with the overseas enterprise.

It should be noted that Qtrade is only primarily available as a mobile app. It’s convenient since you can trade anywhere but if you’re the type to do it on a laptop or PC, the UX would be different since their website is only in its beta stage.

Apart from that, one of the things that we really like about Qtrade is its easy-to-navigate interface. Their sleek UI sets them apart from the other competitors and makes themselves really eye-catching to investors who favor simplicity.

Qtrade’s site is simple to use and doesn’t offer any complicated charting software or analysis tools. it sticks to the essentials and prioritizes a cleaner layout, which is great for beginner traders

Apart from stocks, this firm can also trade ETFs and selected cryptocurrency. It gives you access to 100 commission-free ETFs as well as many additional commission-free mutual funds.

Pros

- New accounts get a cash bonus

- No account minimum, annual administrative fee

- Demo account available

Cons

- Primarily available as a mobile app

- Lack of tools and investment analytics

Customer Reviews:

I have nothing but exceptional service with Questrade.

”I have had nothing but exceptional service with Questrade since joining last year – the online chat system is super convenient as you don’t have to wait on hold over the phone. They always fix any issue I have right away, and the platform is so easy to use. They also have a ton of online resources to help with research and FAQs.”

I have been using Questrade for 4+ years now.

“I have been using Questrade for 4+ years now. I have the self directed trading account for my tax free savings account and my retirement savings account. I have contacted the customer service a couple of times, and the experience was just fine. Many of my friends use Questrade too. Its trustworthy, charges lesser fees compared to the big banks, and the company is growing like hell (must be a reason why). Overall, I am a happy Questrade customer. Note: I have only used their self directed investment service. Questrade also offers managed investing.”

4. TD Direct Investing

| Criteria | Rating |

| Commission and Fees | ★★★★☆ (4/5) |

| Deposits/Fund fees | ★★★☆☆ (3/5) |

| Trades/Margin | ★★★★★ (5/5) |

| Customer Satisfaction | ★★★★★ (5/5) |

| UX/UI | ★★★★★ (5/5) |

| Services | ★★★★☆ (4/5) |

| Security | ★★★★★ (5/5) |

| Range of Offerings | ★★★★★ (5/5) |

TD Direct Investment comes into this list as not only a broker with a higher price point, but also one that provides investors with a diverse set of trading tools and research materials. They offer personalized platforms to the level, skill, and transaction volume of the trader.

We’d like to point out TD’s strong suit is providing users with a wide range of third-party research from reputable sources such as the Federal Reserve Economic Database, Center for Financial Research and Analysis, and Morningstar, all of which are available for free. This is beneficial for both newbies and veteran traders who want a handy reference.

This broker offers a stunning UX/UI thanks to its smooth website as well as its mobile app. Despite their good services, we still want to point out that they do have a steep inactivity fee, so if you’re not an active trader, pass on this option.

There are also additional administrative fees apart from this, such as a $25 fee for a partial account withdrawal. A $100 fee is charged for the full RRSP account withdrawal.

Having said this, we actually really like the failsafe that TD provides its clients. They promise a 100% reimbursement of the account losses in an event that you lose money in any unauthorized transactions.

TD also offers a wide range of investment options, from a broad variety of low-cost mutual funds to complex products such as futures and currency trading. They also offer no account minimum, as well as 7 different accounts for your preference.

Pros

- Low trading fees

- Great customer support

- No account minimum

- Professional-level trading platforms

Cons

- Pricing not availabHigh fees compared to other competitors

- $25 quarterly inactivity fee if your account has less than $15,000le on website

Customer Reviews:

The TD Team will always spend time explaining things.

“I am new to trading and moved over from just saving in Acorns and a savings account to investing in safer stocks in the Dow Jones. I am taking a class about covered calls and volatility trading but am super new to the whole idea. I love that I can get on the phone and chat through any question big or small and the TD team will always spend time explaining things and even make suggestions and teach me new methods of trading.”

I would recommend anyone to try them.

“They have great customer service and their fees are extremely fair. I haven’t had any issues with them and I’ve been with them for more than a decade. They’ve always been helpful when I had questions or problems. I would recommend anyone to try them.”

5. Interactive Brokers LLC

| Criteria | Rating |

| Commission and Fees | ★★★★★ (5/5) |

| Deposits/Fund fees | ★★★★★ (5/5) |

| Trades/Margin | ★★★★★ (5/5) |

| Customer Satisfaction | ★★★★☆ (4/5) |

| UX/UI | ★★★★☆ (4/5) |

| Services | ★★★★☆ (4/5) |

| Security | ★★★★★ (5/5) |

| Range of Offerings | ★★★★★ (5/5) |

While Interactive Brokers is not for novice investors, it is the industry leader in international trading and offers the low commissions that professional traders prefer. In terms of fees and tools, Interactive Brokers’ offering is by far the most expansive.

Interactive Brokers has one of the most comprehensive portfolios in the market, and it dominates in a number of categories, including international trading. Customers can trade in over 135 international markets in 33 countries across the world.

The margin rates at Interactive Brokers are significantly cheaper than those of the competition. Whereas many brokers charge over 10% interest on the first dollar of margin, Interactive Brokers charges a third as much for margin loans.

The difference can be significant, especially for investors who hold substantial margin balances over extended periods of time. This is also primarily the reason why pro traders flock to this trading platform.

Though what we don’t like is how convoluted their website is, Interactive Brokers’ website has a lot of information, but finding and analyzing the information you need isn’t always straightforward.

All in all, Interactive Brokers is a sophisticated trading platform that includes strong technical and fundamental research. They offer over 7,000 no-transaction-fee mutual funds, which makes it a really strong choice for veteran brokers.

Pros

- Best for pros who like to trade on a daily basis

- 135 markets across 33 countries

- Over 7,000 no-transaction-fee mutual funds

Cons

- Pricing not availaWebsite is difficult to navigate

- Not beginner-friendly ble on website

Customer Reviews:

I never had to wait more than a few minutes for everything to be resolved.

“I have been using Interactive Brokers for almost 2 years. The platforms work well, you can get a lot of analysis and information on stocks or ETFs, I have never had any problems with execution neither in the Trader Workstation nor in the mobile app or client portal and the commissions are low. I mainly use the chat if I have problems, doubts or something to ask and have never had to wait more than a few minutes for everything to be resolved.”

A broker for the professional.

“A broker for the professional. No frippery, but serious implementation of trading ideas. Not the cheapest, but fair. Execution very good. Strong in foreign exchange and trading of shares, ETF and derivatives. Bonds and funds rather less. I am satisfied.”

Frequently Asked Questions

And there you have it! We hope this list helped you decide on the best online stock broker for you. Think we missed a really good broker? Well, shoot us a message and we’ll definitely check it out!

Have some other financing issues in mind? Check out our other recommendations: